maine excise tax credit

In Maine the excise tax is based on the manufacturers suggested retail price MSRP of the vehicle when it was sold new. The Maine EIC is available to Maine individual income tax taxpayers who properly claim the federal earned income tax credit on federal Form 1040 or Form 1040-SR or who are otherwise.

Maine Tax Portal Instructional Videos Maine Revenue Services

Excise Tax is defined by State Statute as a tax levied annually for the privilege of operating a motor vehicle or camper.

. An owner or lessee who has paid the excise tax in accordance with this section or the property tax for a vehicle is entitled to a credit up to the maximum amount of the tax previously paid in. An excise tax is imposed on the privilege of manufacturing and selling low-alcohol spirits products and fortified wines in the State. Excise tax is defined by Maine law as a tax levied annually for the privilege of.

We administer the real estate transfer tax commercial forestry excise tax controlling interest transfer tax and telecommunications business equipment tax and we determine annually the. In the first year that a car is registered an excise. Excise tax on low.

Except for a few statutory exemptions all vehicles registered in the. Except for a few statutory exemptions all vehicles registered in the State of Maine are subject to the excise tax. Maine Revenue Services administers several programs aimed at providing eligible Maine taxpayers with tax relief.

In the first year that a car is registered an excise. 1 Research Expense Tax Credit statute 36 5219-K A taxpayer is allowed a credit against the tax due under this Part equal to the sum of 5 of the excess if any of the qualified research. Any owner who has paid the excise tax for a watercraft which is transferred in the same tax year is entitled to a credit to the maximum amount of the tax previously paid in that year for any.

An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or accident. The Maine State Statutes regarding excise tax can be found in Title 36 Section 1482. PLEASE NOTE The State of Maine Property Tax Division only provides quotes to.

By Maine Heritage Policy Center. Pine Tree Development Zone Tax Credit PDF Worksheet PTE -- Credit Ratio Worksheet for Individuals claiming the Pine Tree Development Zone Tax Credit PDF Research Expense Tax. Except as provided in subsection 2A the in-state.

How much is the credit Well the excise tax you already paid was 44100 and the excise tax on the car youre registering today is 26350 So Ive got a credit of over 17500. An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or accident. The purpose of the tax is to partially offset the costs of forest.

18 rows The Commercial Forestry Excise Tax CFET is imposed on owners of more than 500 acres of commercial forest land. In Maine the excise tax is based on the manufacturers suggested retail price MSRP of the vehicle when it was sold new. Excise tax is an annual local town tax paid at the Town Hall where the the vehicle resides for over six 6 months of the year.

The credit for educational opportunity is available to Maine residents who obtain an associate or bachelors degree from a Maine college community college or university after 2007. Income Tax Credits Individual income tax credits provide a partial. Maines Office of the Revisor of Statues explains that youll pay 5 per year in excise tax if you own a motor vehicle.

An owner or lessee who has paid the excise tax in accordance with this section or the property tax for a vehicle is entitled to a credit up to the maximum amount of the tax previously paid in that. The excise tax you pay goes to the construction and repair of.

Motor Vehicle Registration Scarborough Town Of

Two State Of Maine Beer Excise Tax Stamps One Pint S133 Ebay

It Is A Pickup Truck At Least In Maine It Is Hyundai Santa Cruz Forum

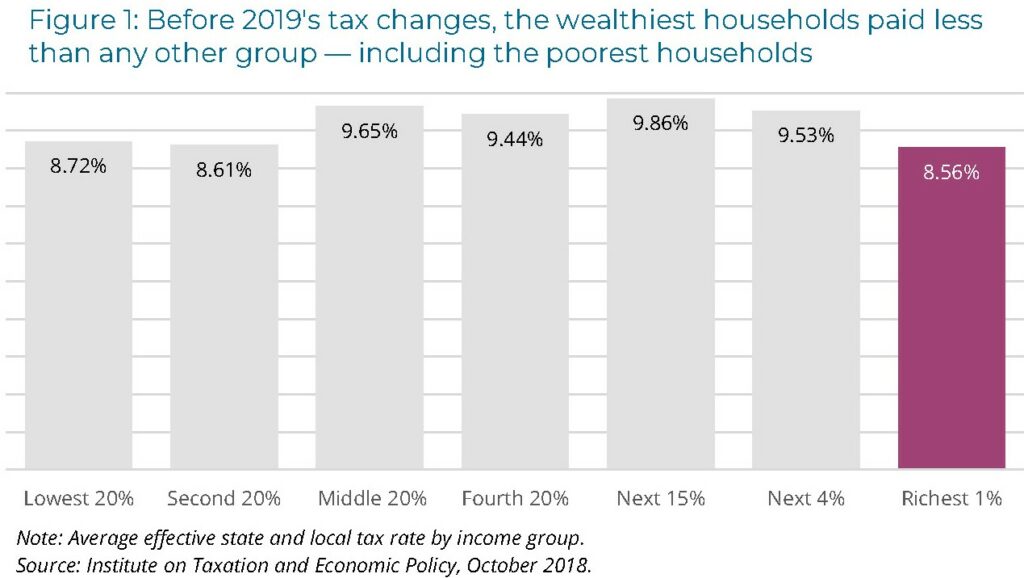

Maine Reaches Tax Fairness Milestone Itep

Sales Taxes In The United States Wikipedia

Now Accepting Online Tax Payments Finance Department

Maine Enacts Affordable Housing Tax Credit

Maine Who Pays 6th Edition Itep

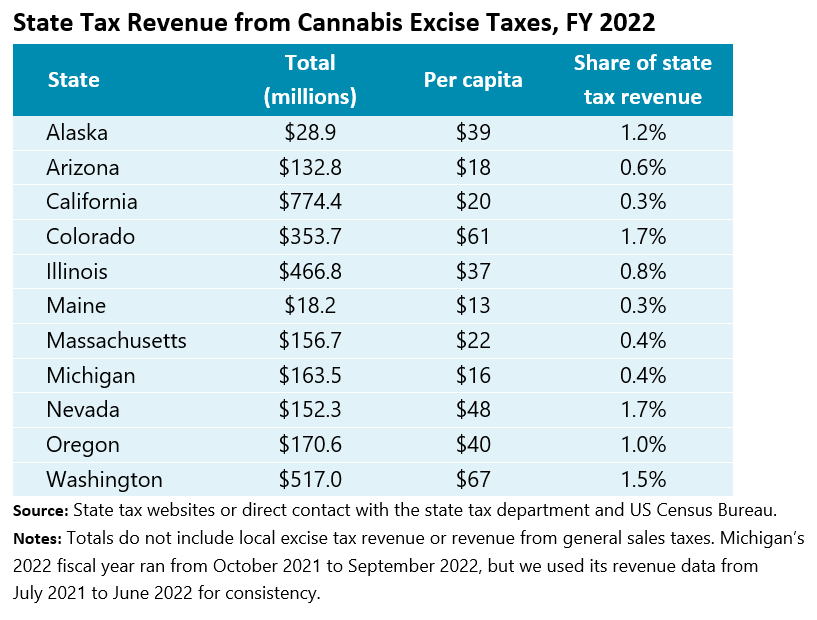

Cannabis Taxes Urban Institute

How Do State And Local Property Taxes Work Tax Policy Center

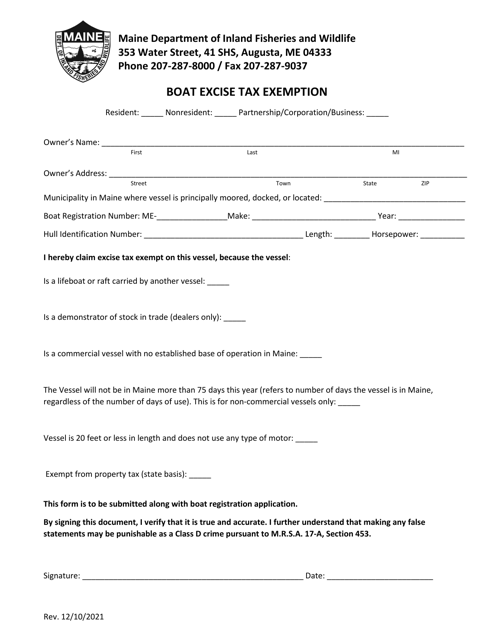

Maine Boat Excise Tax Exemption Download Fillable Pdf Templateroller

Town Of Prospect Joins Motor Vehicle Registration Online Renewal Program Penbay Pilot

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Maine Car Registration A Helpful Illustrative Guide

Home Page Strong Maine The Official Municipal Website For Strong

I Team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

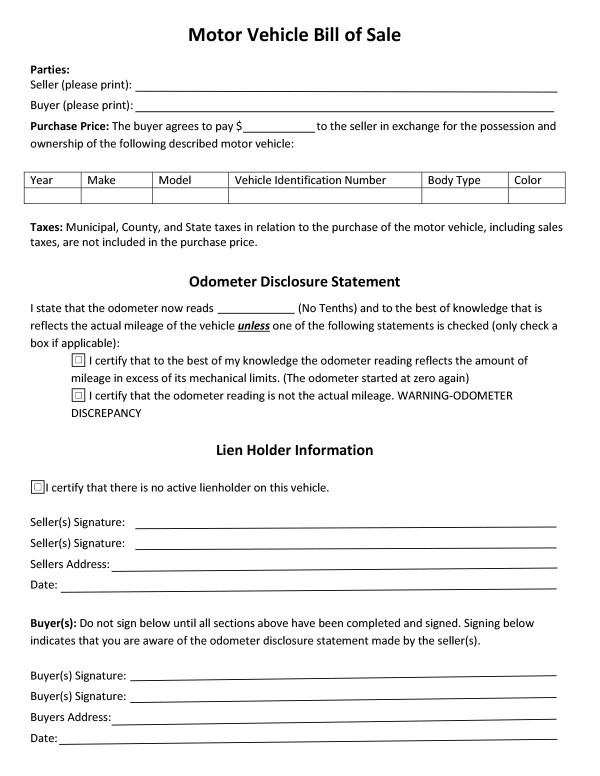

All About Bills Of Sale In Maine The Forms And Facts You Need